TaxDome vs Canopy (Comparison for 2025)

TL;DR Both platforms streamline firm workflows. TaxDome is an affordable, all in one pick for small teams; Canopy costs more but offers modular add ons and unrivaled IRS transcript features.

Why Compare TaxDome Vs Canopy Comparison

Search interest for comparing TaxDome and Canopy keeps climbing in 2025 as firms look for a single source of truth instead of juggling half a dozen niche apps. Updated pricing and AI powered workflow releases on both sides make last year’s blog posts feel dusty, so here’s the fresh low down—minus the sales fluff.

(If you already know TaxDome isn’t for you, check our deep dive on TaxDome alternatives or jump straight to the TaxDome alternative that firms like yours are switching to.)

TaxDome vs Canopy: What They Are

TaxDome is an all in one practice management platform built primarily for small to midsize tax, bookkeeping, and accounting firms. It bundles a client portal, document storage, e-signatures, workflow automation, email syncing, and billing into a single subscription.

Canopy is a modular practice management suite that began with IRS transcript and tax resolution tools and now offers client management, document management, workflow, time & billing, and integrated payments. Firms pay per user and can toggle individual modules on or off.

Because both apps aim to be the operating system for modern accounting practices—handling documents, client communication, payments, and compliance—they’re natural alternatives. Most firms evaluating practice management software shortlist TaxDome vs Canopy first to decide between an all inclusive bundle (TaxDome) or a flexible, pay as you grow stack (Canopy).

TaxDome Vs Canopy: Feature by Feature Comparison

Client Portal

A modern client portal is the front door to your firm. It lets clients send and receive files, sign forms, and more in one secure, self serve space—without endless email threads.

- TaxDome: Unlimited clients, fully white labeled web & mobile portals, granular folder permissions, guest viewer links.

- Canopy: Branded portal with iOS/Android apps, built in chat threads, firm logo branding but Canopy footer remains.

Project Management

Project (or task) management features keep every tax return, bookkeeping cycle, and advisory engagement moving on schedule. Task lists, due date tracking, and capacity views ensure nothing slips past deadlines.

- TaxDome: Kanban style pipelines with automation triggers, recurring jobs, and color coded priorities.

- Canopy: Task lists with dependencies, workload dashboard, and capacity planning baked into the Workflow module.

Document Management

Document management covers storage, version control, and e-sign workflows. The right system lets staff and clients find files in seconds while staying audit ready.

- TaxDome: Truly unlimited storage on every tier, desktop uploader, automatic folder creation based on job template.

- Canopy: Unlimited storage only with Document Management add on; drag and drop upload, version history, granular permissions.

Knowledge Base

A built in knowledge base lets you publish help articles and FAQs so clients can self serve answers 24/7—cutting down repetitive “how do I…?” emails.

- TaxDome: No standalone knowledge base, but you can embed FAQ pages and help articles inside the client portal.

- Canopy: Offers a lightweight Help Center where clients can search firm curated articles alongside their documents.

Forms

Digital forms replace paper organizers and PDF questionnaires. Conditional logic and auto reminders streamline data collection before each engagement.

- TaxDome: Custom "Organizers" with conditional logic and e-signatures, reusable across pipelines.

- Canopy: Client Requests & Forms allow custom fields, auto reminders, and engagement letters in one flow.

Contracts

Engagement letters and contracts set scope and fees up front. Integrated e-signatures lock in agreements fast, without bouncing between doc signing apps.

- TaxDome: Engagement letter templates with merge fields and legally binding e-signatures on every plan.

- Canopy: Engagement templates live inside the Document Management module; signatures via native e-sign or KBA add on.

Reporting

Practice analytics turn raw time tracking and project data into insights on capacity, realization, and profitability—so you can make data driven staffing and pricing calls.

- TaxDome: AI Activity Insights dashboard covers job velocity, team workload, and revenue projections.

- Canopy: Time & Billing reports feed utilization, realization, and profitability charts.

CRM

The built-in CRM stores every note, email, and call in a single timeline, giving staff full context before reaching out to a client or prospect.

- TaxDome: Unified client CRM with custom tags, email sync, and pipeline stages.

- Canopy: Extensive client record, timeline of interactions, email sync, and collection tracking.

Invoice and Billing

Integrated billing converts completed work into invoices in a few clicks and embeds payment links that speed up cash flow.

- TaxDome: One off or recurring invoices, estimates, payment automations, Stripe & CPACharge with no extra fees.

- Canopy: Time entries roll into invoices, optional surcharging for credit card fees, supports ACH and credit card payments.

TaxDome Vs Canopy: Key Differences That Matter in 2025

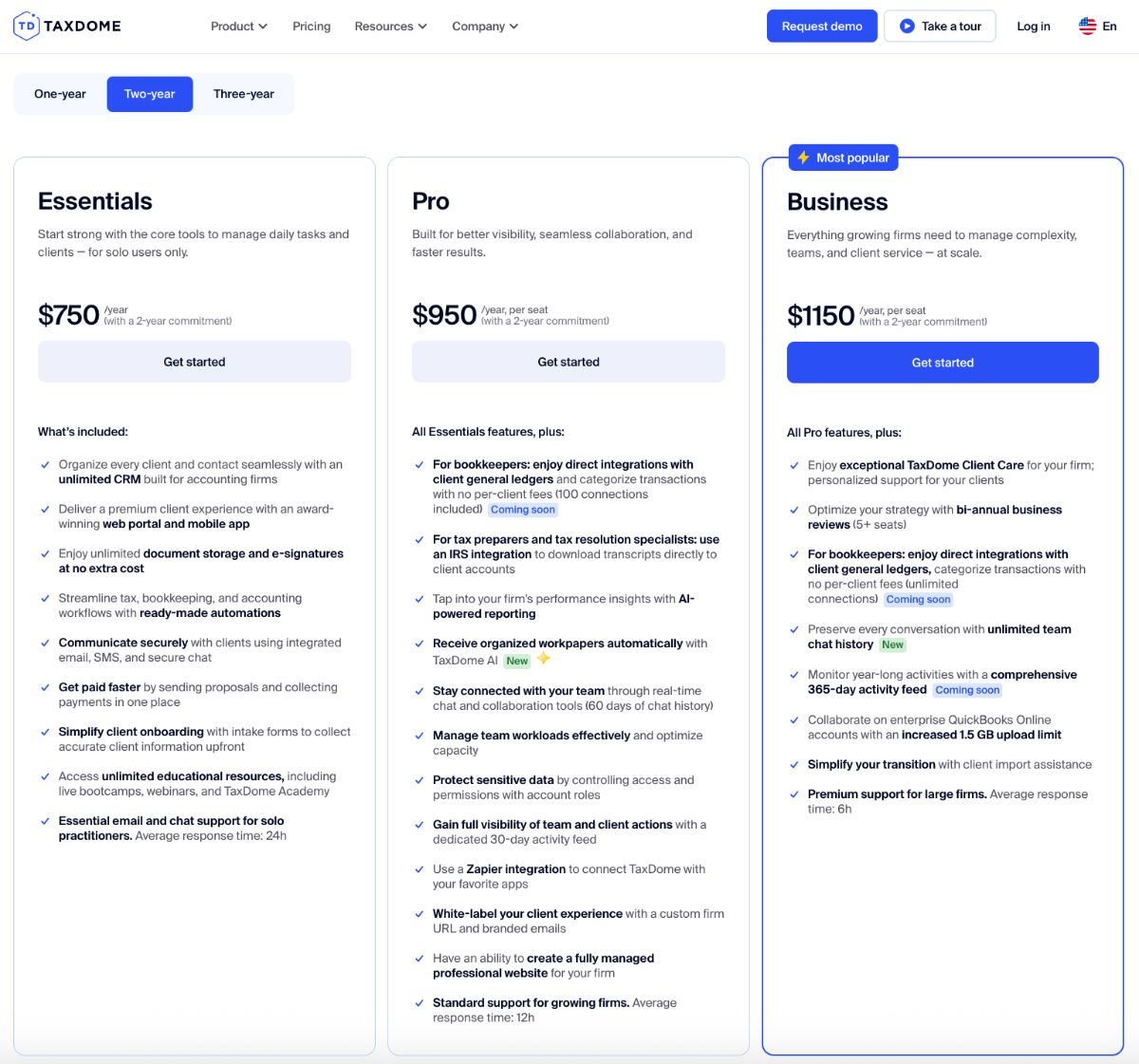

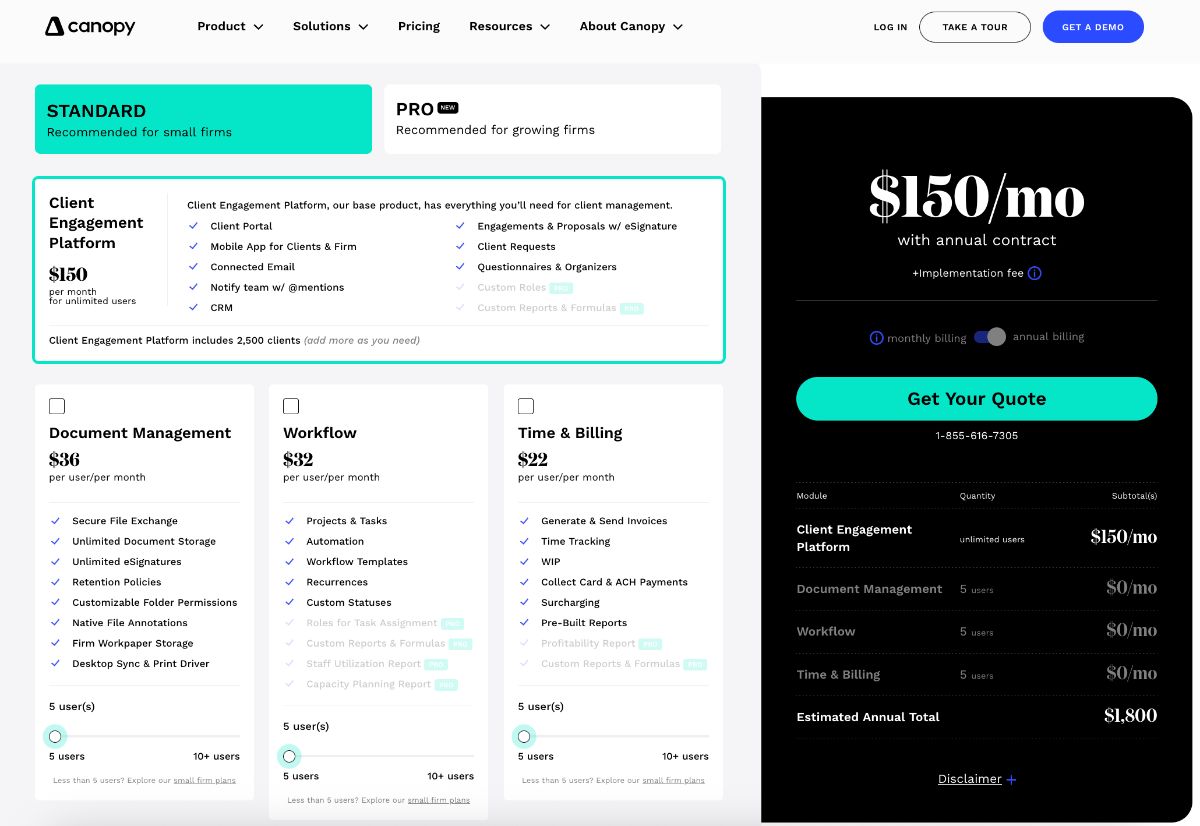

1. Pricing & Seat Flexibility

TaxDome pricing is simpler with three concise plans for the solution. Canopy pricing lets you add just the modules you need, but costs stack up fast as you unlock more features.

TaxDome Pricing

Canopy Pricing

2. Onboarding & Ease of Use

- TaxDome ships with opinionated templates (pipelines, organizers, folders) so a solo practitioner can be live in a weekend.

- Canopy feels more enterprise ready and lets you build processes from scratch—but the initial setup can take longer unless you spring for paid implementation.

3. Document Management & E-Sign

- TaxDome: Unlimited storage and unlimited e-signatures on every plan. Desktop uploader plus auto generated folder structures keep files organized with minimal setup.

- Canopy: Unlimited storage only when you purchase the Document Management add on (from $36/user/mo). Native e-signatures, version history, and granular permissions are solid—but cost extra.

TaxDome Vs Canopy: Integrations & Ecosystem

| Integration | TaxDome | Canopy |

|---|---|---|

QuickBooks Online sync | 2 way sync | 2 way sync |

Zapier / Make.com | 5,000+ apps via Zapier & Make | 5,000+ apps via Zapier |

IRS Transcript Delivery Service (TDS) | Via third party connector | Built-in |

Payments (Stripe / CPACharge) | Stripe & CPACharge | Stripe (built-in, surcharging available) |

Calendar (Google / Outlook) | 2 way sync | 2 way sync |

Both solutions cover the fundamentals—portal, docs, e*sign, basic automation, and payments—so the real decision comes down to pricing, depth of certain modules, and firm size.

TaxDome Vs Canopy: Customer Support & Community

Support & Community | TaxDome | Canopy |

Live chat | 24×5 in-app chat | 24x5 in-app chat |

Phone support | US business hours (9am–8pm ET) | US business hours (8am–6pm MT) |

Email / tickets | Same-day responses | Same-day responses |

Training | Free Bootcamp webinars; 1 on 1 setup for Pro+ | Paid implementation packages (from $1.5K); weekly live trainings |

Knowledge base | TaxDome Help Center & Academy courses | Canopy Help Center, certification courses |

Community forums | Facebook & Slack groups (13*K+ members) | Facebook Community (9*K+ members) |

TaxDome Vs Canopy: Real World Sentiment

TaxDome | Canopy | |

Capterra | 4.7 (3,477 reviews) | 4.5 (230 reviews) |

G2 | 4.7 (635 reviews) | 4.6 (459 reviews) |

“Has helped me stay organized, streamline communication with clients, and maintain a more professional image. The platform makes it easy to manage documents, collect e-signatures, and keep everything in one place", July 2025 (Capterra - TaxDome)

“It makes sense, it has everything you want. Easy to use, implementation was a breeze. Support has been good. Wait times have almost always been low.” July 2025 (Canopy - G2)

User reviews consistently praise TaxDome for consolidation and Canopy for its IRS focus. Complaints center on UI complexity (TaxDome) and add on costs (Canopy).

When TaxDome Makes More Sense

For solo practitioners and small firms (usually under ten users), TaxDome’s predictable per seat pricing and all in one approach deliver the most bang for the buck. Unlimited e-signatures and document storage come standard, and the pre-built pipelines, organizers, and engagement letters mean most firms can roll out the software in a single weekend without outside consultants.

Explore a simpler TaxDome alternative if you’re feeling feature overwhelm.

When Canopy Makes More Sense

Canopy is the stronger fit for mid-size and larger practices that depend on IRS transcript pulls or need granular control over which modules they pay for. Firms with ten or more staff often justify the higher per user cost thanks to Canopy’s advanced time & billing metrics, capacity planning dashboards, and built-in notice-resolution workflows. If you have a dedicated operations team and prefer enterprise*style implementation, Canopy’s modular stack can scale with you.

How Does Foyer Fit Into the Mix?

If you’ve researched TaxDome vs Canopy and you're looking for a solution that excels at client portal software, Foyer might be your option—streamlined workflows without the enterprise bloat. Try out Foyer's 14 day free trial, no commitment required.

FAQs

Is TaxDome cheaper than Canopy? Yes—if you’re a small team. TaxDome’s Pro plan averages ~$83 per user monthly when billed annually, while matching Canopy’s feature set could run $110+ per user after modules.

Does Canopy replace my e-signature tool? Only if you spring for the Document Management module; otherwise you’ll still pay for a separate e-sign provider.

Can I migrate data from Canopy to TaxDome (or vice versa)? Both offer CSV exports and migration guides, but TaxDome’s bootcamp program includes live migration support at no extra cost.

Security & Compliance

Security & Compliance | TaxDome | Canopy |

SOC 2 Type II | Certified (Trust Center) | Certified |

GDPR readiness | EU data centers & DPA | EU data centers & DPA |

Encryption at rest & in-transit | 256-bit AES & TLS 1.2+ | 256-bit AES & TLS 1.2+ |

MFA / SSO | MFA, SSO (Pro+) | MFA, SSO |

Both Taxdome and Canopy meet baseline security expectations—SOC 2 audits, GDPR alignment, and end to end encryption. TaxDome surfaces certs in its public Trust Center, while Canopy adds optional SSO for enterprise plans.

Final Thoughts

Choosing between TaxDome and Canopy isn’t about which logo looks cooler—it’s about where your firm is headed. If you need turnkey, affordable, all in one software this tax season, TaxDome probably edges it. If IRS transcript automation and modular scalability top your wishlist, Canopy is worth the higher per user spend. And if both feel like overkill, Foyer is always here to help you work smarter, not harder.